I learned a lot about what has led to the large inequality between the uber wealthy and the rest of us. I was already familiar with most of the statistics. The history, legislation, etc. were new. I am just putting the information out there. I plan to read the material for each class and go through them again to study the history, legislation, etc.

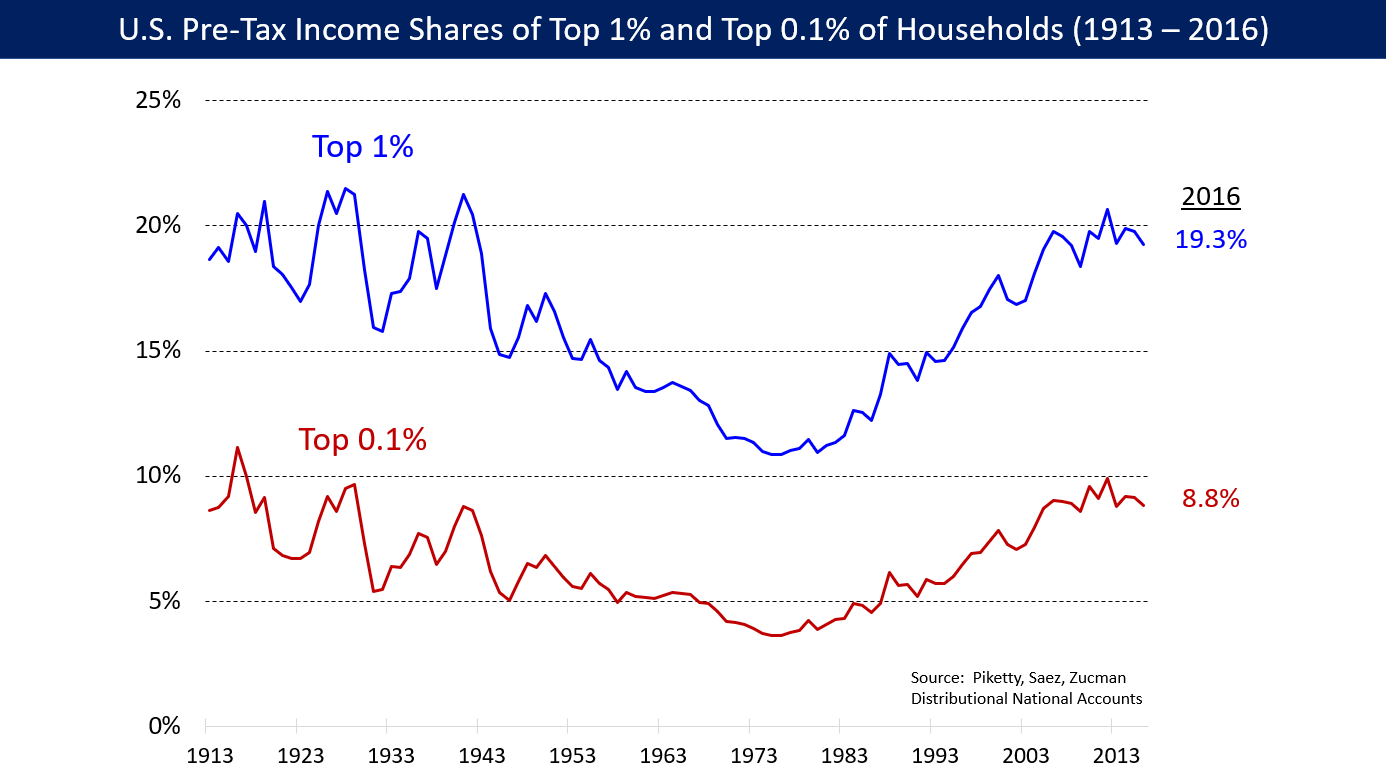

This has been building for generations now. It seems ever since I was born, the trend has steadily eroded the wealth of the average citizen. What changed in the mid-70’s? Lots of things; hard to pick one. It’s an abrupt turn-around in the trend for both the rich, the middle, and the poor, so the odds that a specific event, policy, or law that reversed the trend are not zero.

I don’t know much about economics except from an armchair quarterback’s position.

Here’s the kind of stats I’ve seen, that are easily found in many places, such as this:

https://www.core-econ.org/visualizing-global-income-and-wealth-distributions/

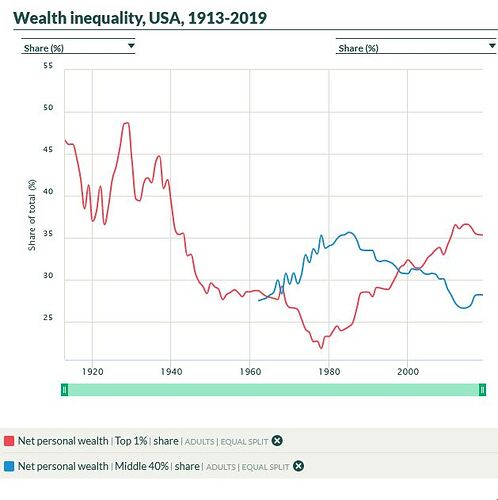

A graph like the one below takes me a few minutes to digest. The “middle 40%” appears to represent annual income, and the graph makes a relationship between an adult’s income and their net wealth, plotting how that’s changed over the years. There are many other ways to display the trend with a similar message. The portion of wealth in the control by a few high-income earners has grown substantially in the past 50 years.

Professor Reich doesn’t accept wealth as a “zero-sum” (Adam Smith and I agree) but if we temporarily adopt that view when looking at a graph like this, then it doesn’t surprise us that the wealth of middle-income Americans has dropped in proportion to the increase for the rich.

When I watch Jon Stewart the solutions seem so obvious.

Basically all of the data stems from government. Reich points that out, too.

I use government data and stats to debate a former colleague, who is really libertarian. He’s a great guy but we are in disagreement often.

The pieces I lacked were the reasons behind the numbers, which Reich provides. I’ve not done extensive research so I don’t know if his explanations are exhaustive. It’s something I want to research.

Reich does not believe in zero-sum wealth but he does accept power as a zero-sum game. I agree with both of those. Musk Bezos, Buffett, Gates, Koch, et al have more power than we do. It’s that exercise of power that began in the 70’s and that exercise of power has continued over the decades of my life and yours to influence public policy. To Reich, it seems to pervert everything, which aligns with my observations.

People are angry in the US and I think the economic disparity is the root cause. People are finding it more and more difficult to keep up. Young people are finding it difficult to get started. Their struggles are much different than my generations in getting started.

However, the power is derived from the money, isn’t it? If they weren’t wealthy, would they even have the same power?

I’m not sure it’s really the disparity, per se, that’s at the root of the anger, but just the lack of improvement in life quality; there used to be a time when people worked hard to make their children’s lives better and rinse and repeat, but now, it’s not clear that’s possible. Part of the problem has always been the “they” that tell you all you need to do is to go to college, but “they” failed to mention that you need to get a useful degree, and you need to not overpay for that degree. Paying $100k for a psychology BA is a losing proposition.

Additionally, “they” have, I think, always had an ulterior motive to have an over supply of talent, so that they could have a seller’s market and not have to pay too much for worker bees. It’s only been in the last 2 years after Covid that the labor market finally tightened and hourly wages have made relatively large gains, but that squeezes the next tier up in salary.

However, regardless of wages, wealth can only realistically grow by maintaining a moderate lifestyle, but that hasn’t really been the case for quite a while, and consumer debt was recently reported at a staggering $1T. I’m retired and constantly amazed at the statistics for retirement savings, or even just the dearth and lack of depth in emergency savings. Suze Orman says that you need $5M or more to retire and most people my age have less than one-tenth of that amount in retirement savings. One thing that’s seriously messed up is the “throw-away” lifestyles we’ve all become used to; things break and we buy replacements, rather than fixing them. Obviously, that’s great for the workers that make the dreck that keeps breaking, but it’s a drain on the consumer’s pocketbooks.

Consumerism is constantly thrown at us and it is part of what keeps the economic engine running. Companies make things we need or perhaps mostly want because they’re bright, colorful, shiny, next cool thing, etc. Advertising has crept into so many more avenues now it’s too much. They also know how to appeal to our hedonism. They research and they are bright, too. How is that ever going to change with the lobbying efforts ongoing?

I was raised with the thoughts of hard work, good education, etc. I now understand how much luck plays into success, long term success. I wish more people understood and acknowledged their good luck. If you watch Robert Reich, it begins with your parents. The stat he presents is 50% of the success puzzle is attributed to a child’s success.

I hear people rail against a lot in this country, e.g., the social safety net, without ever experiencing the need for it thus the mechanisms to use it. I used to be one of those because I bought into the hard work, good education, etc. will insulate one from complete and utter failure. Experience has taught me how life and the social safety net, doesn’t work for so many people. Because you need it doesn’t mean you will get it.

Some, in the ranks of the uber wealthy, have written about their positions and their desire to keep others out. And, when one of them falls on hard times, others, in their ranks, are there to help them out and lift them up again. I certainly have not experienced that and I know others that haven’t. The latter is not a bad reflection on them but a good one.

The wealth and income gap is the root of the problems, to me. When you hear the history that Reich presents, you begin to understand the depth and breadth of the problems it causes. You learn about the pre-distribution of wealth, which “they” don’t want to discuss. “They” are quite content for us to rail upon redistribution of wealth.

If you cannot keep up with inflation or, better yet, get ahead and stay there, you cannot avoid consumer debt. I began to fall behind in my late 30’s and it got much worse with Lyme disease, CIRS, etc. I was well on my way to a nice retirement but evidently I got too big for my britches and thought I could do things I obviously cannot do. And there is no help for me. I will be working until I drop now, which is OK. But don’t expect me to cry for or side with the uber wealthy. They have way more money thus power than me and so many others. The data and history sum them up quite effectively.

I don’t mind people having great wealth but “they” need to understand their good luck and “they” need to understand noblesse oblige and pay their fair share of taxes, community contributions, etc. Many simply want to be able to improve their lots in life and those of their children. That’s not been happening most of my lifetime. And, if you can’t keep up, you’re going to incur consumer debt to keep up.

A former colleague once said he would have made more money and been happier running his dad’s painting business rather than being an EE.

Reich’s history gave me a better understanding of the data and stats. What he said aligns with what an attorney friend has been telling me about some of the uber wealthy and how they get there. It’s not moral, in my book, but that doesn’t mean much, when it’s legal.

Many economists have been saying similar things and based upon the same data and history. I’ve read and listened to Emmanuel Saez, Thomas Piketty, Paul Krugman, Joseph Stiglitz, Ben Bernanke, Friedman, Greenspan, Yellen, Sachs, et al to educate myself and try to figure out what happened and how to get on track again. I don’t think I can do it and don’t have enough time left. I think I am already defeated but just can’t admit it and move on, which may be the worst thing for me, as it may cause even worse defeat. I’m so close to giving up.

I don’t want younger people to experience what I and so many others have. When you understand the money flows, there is no real reason for it, either. We can do better but we need to understand the whys to work out the hows to better help everyone get ahead.

re. consumerism – That’s also partly, maybe hugely, a familial culture thing, I think; my family grew up frugally, partly because we were technically lower middle class, but we fixed things until they were too broken to fix and my mom made here own clothes, sometimes. My aunt, however would show up every couple of weeks with a dozen cans of soup or whatever, and they were always, “ on sale” but she was giving them away??? While the anti-drug message of “Just say no” might have been a bit too simple, family influence can certain train children to “Just say no” when it comes to frivolous purchases.

Family plays a critical role, both in how wealthy they were, and what their care-abouts were; certainly, we weren’t wealthy; college was a combination of some scholarships, grants, and student loans, so not much help from the parents financially, and no special college-prep programs. But, education was drilled into us as THE means to the ends that we all desired. Luck, nevertheless, also plays into the results, but as was pointed on a Veritassium video, downplaying luck is something that people tend to downplay, as it’s a zero sum game against our innate abilities. https://www.youtube.com/watch?v=3LopI4YeC4I&t=80s

Veritassium also points out that the luck of when someone is born has a LOT to do with future success; if you are born such that you’re the oldest in your class or a sports tryout cohort, you tend to be bigger and stronger compared to others in your age group, thereby getting more attention and more coaching, etc., rinse and repeat.

Re. safety net – America’s culture, as exemplified by the whole “hard work and education” bit is somewhat rooted in the Puritan ideals, and if you don’t succeed, then you didn’t work hard enough, etc. So while we, as a society, empathize and want to help the less fortunate (there’s the luck factor, isn’t there?), we subconsciously believe that they either deserve their situation, or they’re trying to play on our good graces, so the qualification process for any kind of help is onerous, and that has only gotten worse since the Clinton administration basically capitulated on work requirements for social aid. And the reality is that there is some percentage of people trying to take advantage of an “easy” buck, as is the case in any social and work situation, because laziness is a certain percentage of our personalities. Of course, there’s a bit of conspiracy theory in the whole “education” bit, since that was partly pushed by companies needing higher skilled worker bees for their factories, and the recent brouhaha with TSMC in Arizona shows that America doesn’t necessarily adhere to that mantra well, and when it does, it fails to consider the ROI of getting a degree from an expensive school that has a lower expected renumeration.

Re. income gap – I’m not convinced that the current societal framework can function without an income gap; do we want to pay janitors the same as engineers and CEO’s? Unless there’s some reward at the end of an endeavor, such as more money, would we really be as motivated to pursue that endeavor? If there’s not a better life for our kids, then is there a point to the whole “hard work and education” mantra? Again, I think it’s changeability of the gap that matters; while current wealth gaps are huge, they were possibly as large a century ago, but people still persevered , although that might just have been the whole “work hard and education” mantra more seriously engrained. Nevertheless, the control of wealth a century ago, at least in terms of income, appears to be comparable to the current state of affairs.

Re. painting business – possibly, but there’s a lot more luck involved in running businesses than most people are willing to admit. If 90% of businesses fail in the first two years, it’s a non-trivial endeavor; especially when you consider that even companies that were successful, say like Montgomery Wards and Sears, which were the Amazons of its day, can completely flop because they misread the market or couldn’t keep up.

irstuff,

Sorry for the delayed response. Been busy and otherwise not up to responding.

Consumerism: We have been encouraged to spend, spend, spend and that messaging has overcome many. Lots of research has been done to determine ways to easily separate people from their money. I’m sure you are aware of this, too, and have probably read some of the research.

Socio/Economic status: I’ve made numerous statements about growing up in poverty. It stinks and definitely changes the way you see the world and your place in the world. We grew up fixing things, too. We grew up reusing Al foil until it was beyond usable. Same with wax paper, paper bags, etc. We worked my uncle’s fields to put food on the table. It taught me a work ethic so I can’t complain about that.

Mother drilled education into us, too. My sister and I understood her and got educated. She laid out her thoughts based upon her experiences/observations as a secretary. Engineering was her last recommendation because engineers worked too many hours, didn’t earn enough, and traveled too much. Medicine was her top recommendation and I wish I had thought more about it.

She also taught us to be happy and satisfied with what we did have. My brother always complained about not having enough, which I mentioned to her, as a kid. Her response, “You have to take care of what you do have to have anything in life.” I thought that was priceless thus have taken care of my stuff.

Because of Mother and my own curiosity, I have been a reader throughout my life. As a kid, I loved Early American History and read every book I could get my hands on. That enabled me to easily pass the DAR test for their history award, which supremely irritated the valedictorian in our class. He told me that I couldn’t possibly have been smart enough to pass that test. It had to be pure luck. It wasn’t because I was smart or pure luck but because of all the reading I had done about American history.

Luck: Is huge and who your parents are can set one up for life. We have many examples of that. For the rest of us, it comes down to learning and being prepared, should the right opportunity arise. For me, it didn’t. I’ve gotten minor lucky breaks but nothing that amounted to much.

Safety net: Growing up in Louisiana, I know your position. From my experience, many need help and there isn’t any, from anywhere. I have helped people, including relatives, that were simply taking advantage of me. I acted out of good conscience and willingness to help so at least I was trying to do the right thing. Since they were duping me, that’s on them. I did the right thing and helped.

And don’t think that uber wealthy folks are industrious beyond us normal, regular folks. They’re just as lazy and many are quite messed up units. They manipulate and can because, well, wealth. Fiona Hill revealed in an interview about a year ago that she watched the familiarity between Musk and Putin. They’re friends because, after all, who are they going to befriend? Us? What a joke. They’re all in the billionaires club. That explained a lot. I’ve read for decades how the wealthy use tax holes to get stuff poor people can’t. Talk about lazy and greedy.

Wealth gap: It’s too large. Period. I’ve watched government stats and it’s too large. Period. The uber rich need to be taxed more heavily. I don’t begrudge them their wealth but they have tilted the scales too heavily in their favor.

Sears/Wards: Mismanagement, in my estimation. Read the history of JC Penny, if you haven’t. Then think about how things are today. Very different philosophies, in my mind.